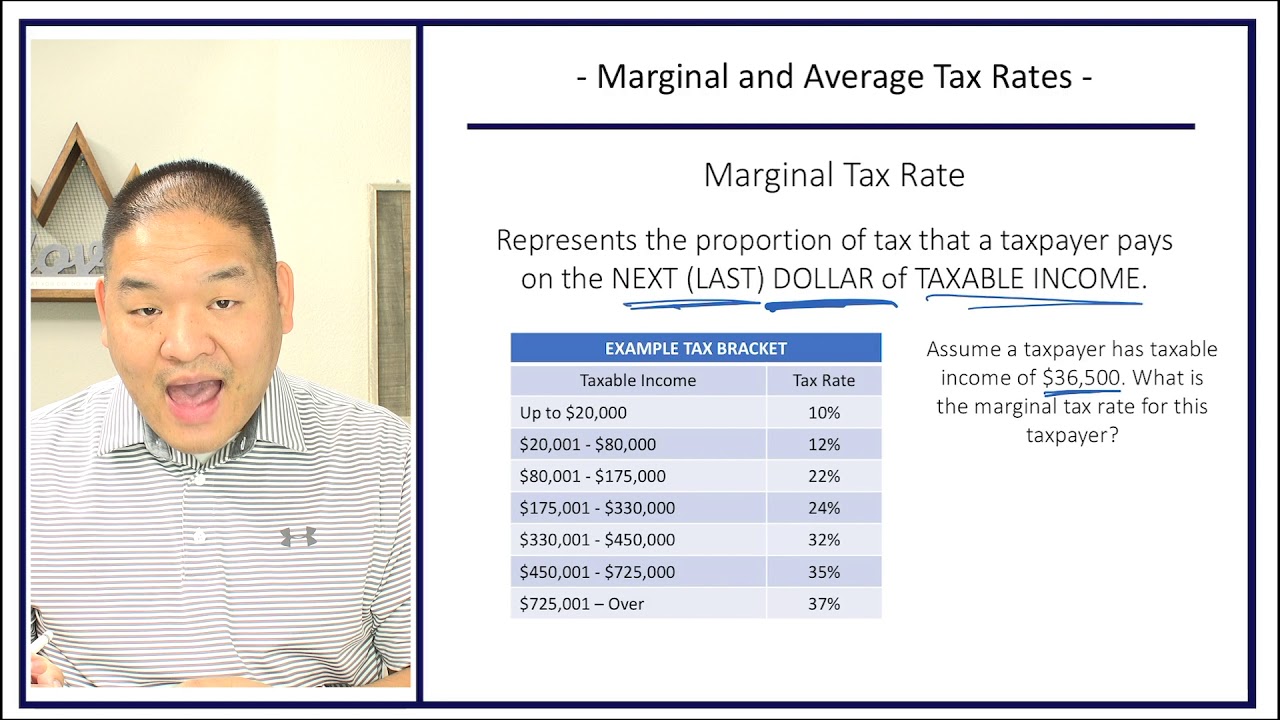

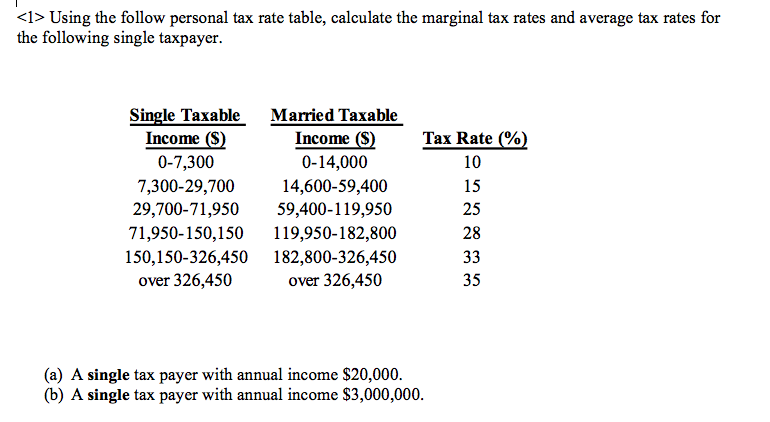

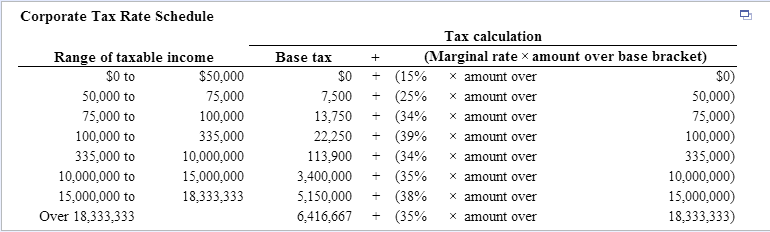

Chapter 01 - Learning Objective 1-2 -- Marginal & Average Tax Rates, and Simple Tax Formula - YouTube

TAXATION!!!. 3 ways governments can bring in $$$ (revenue) WHICH ONE BRINGS IN (BY FAR) THE MOST? TAXES (DIRECT & INDIRECT) THE SALE OF GOODS AND SERVICES. - ppt download

![Solved Problem 2-5 Calculating Taxes (LO3] Timmy Tappan is | Chegg.com Solved Problem 2-5 Calculating Taxes (LO3] Timmy Tappan is | Chegg.com](https://media.cheggcdn.com/media/97f/97f363d0-6902-47f2-a5c5-bd1f7b67e207/php0vmcSc)